Privacy of Consumer Financial Information

Purpose and Objectives

This policy reaffirms and formalizes the Bank’s realization of and respect for the privacy expectations and rights of our customers regarding financial information and other related information which the Bank has or gathers in the normal course of business. It is intended to provide guidance to bank personnel as well as assurance to our customers. We will also, of course, act in compliance with all applicable laws and regulations.

Definitions

Employee: For the purpose of this policy, it includes all directors, officers, and employees of the Bank as well as any attorneys, agents, or outside vendors, who become privy to customer information.

Consumer: An individual who obtains or has obtained a financial product or service from a bank that is to be used primarily for personal, family, or household purposes, or that individual's legal representative. An example of a consumer would be a loan applicant. A consumer is not necessarily a customer.

Customer: A person who has established a continuing relationship with our bank. (For example, an approved loan applicant who signs a note would become a customer).

Nonpublic personal information: Personally, identifiable information relating to a consumer, except when there is a reasonable belief that the information is publicly available. For example: the fact of a customer relationship with the bank, presumably, would be nonpublic personal information. It is only if personally identifiable information relating to a consumer is publicly available, that such information is excluded from nonpublic information.

Publicly available information: Any information that a bank has a reasonable basis to believe is lawfully made available to the general public from Federal, State, or local government records; widely distributed media; or disclosures to the general public that are required to be made by Federal, State, or local law. (For example, a published telephone directory, or the public record of real estate transactions.)

Responsibility

The Board of Directors has the ultimate responsibility to appropriately establish and maintain this policy and assure that it is being observed in the daily operations of the Bank. The Chief Executive Officer is responsible for carrying out this policy and making recommendations to the board of directors as to necessary or desirable changes to the policy.

Privacy Principles

The Bank recognizes the following eight elements of its privacy policy, which have become standard within the banking industry:

- Recognition of Customer’s Expectation of Privacy

- Use, Collection and Retention of Customer Information

- Maintenance of Accurate Information

- Limiting Employee Access to Information

- Protection of Information via Established Security Procedures

- Restrictions on the Disclosure of Consumer Information

- Maintaining Customer Privacy in Business Relationships with Third Parties

- Disclosure of Privacy Principles to Customers

Recognition of Customer’s Expectation of Privacy

Customers of our bank are entitled to the assurance that information concerning their financial circumstances and personal lives, which the Bank has obtained through various means, will be treated with the highest degree of confidentiality and respect. Certain expectations of privacy also contain legal rights of customers which are either granted or confirmed to them through various federal and state laws and regulations. All employees are directed by this policy to assure customers of the Bank’s commitment to preserving the privacy of their information. The Bank will post a notice in its banking office and on its Web site when developed which contains an abbreviated version of this policy. That notice is included as part of this policy and is designed to be both a posted notice and a direct disclosure to customers under circumstances described later in this policy.

Use, Collection and Retention of Consumer Information

It is the policy and practice of the Bank to collect, retain and use information about consumers and customers only where the Bank reasonably believes the gathering of such information would be useful and allowed by law to administer the Bank’s business and/or to provide products, services or opportunities to its customers.

Maintenance of Accurate Information

Management is directed to establish procedures to ensure that, to the extent practicable, all customer financial information is accurate, current, and complete in accordance with reasonable commercial standards. The Bank will further undertake to record that such corrective action was requested by the customer.

Limitation on Employee Access

Management will take steps necessary to ensure that only employees with a legitimate business reason for knowing personally identifiable customer information shall have access to such information. To the extent practicable, access will be limited by computer access codes and granting limited access to areas in which sensitive customer information is retained. Employees will be informed at the time of their initial employment of these standards and periodically reminded of these standards during training sessions at least once during each calendar year. Willful violation of this element of this policy will result in disciplinary action against the offending individual. Inadvertent violations will be dealt with in a manner to ensure that such violations are not repeated.

Protection of Information

The Bank will maintain appropriate security standards and procedures to prevent unauthorized access to customer information. Such procedures should prevent access by not only unauthorized employees, but others as well. Such others include but are not limited to, all non-employees with otherwise legitimate reasons for being on bank premises, computer hackers, and any intruders on bank premises.

General Restriction on the Disclosure of Customer Information

The Bank will not, except in cases allowed or required under the law, reveal specific information about customer accounts or other nonpublic personal information.

Business Relationships with Third Parties

If the Bank is requested to provide personally identifiable information to a third party, from which the consumer has no right to opt out, and that request is in all respects consistent with other elements of this policy, the Bank will accede to the request only if the Bank believes that the party adheres to similar privacy principles, no less stringent than set forth in this policy, that provide for keeping such information confidential.

The Bank will not enter into an agreement with any entity covered under the first category of exceptions, listed below, without first requiring the entity to maintain the confidentiality and limit the third party’s use of the information solely to the purposes for which it is disclosed or as otherwise permitted by law.

Disclosure of Privacy Principles to Customers

Disclosure of the privacy notice (appended as a part of this policy) shall be provided to customers initially and then annually thereafter. The Board of Directors of the Bank have adopted the calendar year as the annual disclosure period.

The notice may be delivered by hand, by mail, or electronically, as specified in the pertinent banking regulation.

Record Keeping and Reporting

Documentation relating to the Bank’s Privacy Policy will be retained for the amount of time required by applicable regulation if applicable.

Review of Policy

The board of directors will make a review of this policy at least once each year and make any revisions and amendments it deems appropriate. The Chief Executive Officer will be responsible for suggesting more frequent revisions as situations or changes in laws or regulations dictate.

Online Statement Verbiage for Website

Bank Privacy Statement

The First National Bank and Trust Company of Weatherford, dba First Bank Texas is committed to protecting your privacy and developing technology that gives you the most powerful and safe online experience. This statement of privacy applies to The First National Bank and Trust Company of Weatherford, dba First Bank Texas web site and governs data collection and usage. By using The First National Bank and Trust Company of Weatherford, dba First Bank Texas web site, you consent to the data practices described in this statement.

Collection of your Personal Information

The First National Bank and Trust Company of Weatherford, dba First Bank Texas collects personally identifiable information such as your e-mail address, name, home or work address, or telephone number. The First National Bank and Trust Company of Weatherford, dba First Bank Texas also collects anonymous demographic information, which is not unique to you, such as your ZIP code, age, gender, preferences, interests, and favorites.

There is also information about your computer hardware and software that is automatically collected by The First National Bank and Trust Company of Weatherford, dba First Bank Texas. This information can include: your IP address, browser type, domain names, access times and referring web site addresses. This information is used by The First National Bank and Trust Company of Weatherford, dba First Bank Texas for the operation of the service, to maintain quality of the service, and to provide general statistics regarding use of The First National Bank and Trust Company of Weatherford, dba First Bank Texas web site.

Please keep in mind that if you directly disclose personally identifiable information or personally sensitive data through The First National Bank and Trust Company of Weatherford, dba First Bank Texas public message boards, this information may be collected and used by others. Note: The First National Bank and Trust Company of Weatherford, dba First Bank Texas does not read any of your private online communications.

The First National Bank and Trust Company of Weatherford, dba First Bank Texas encourages you to review the privacy statements of Web sites you choose to link to from The First National Bank and Trust Company of Weatherford, dba First Bank Texas so that you can understand how those Web sites collect, use and share your information. The First National Bank and Trust Company of Weatherford, dba First Bank Texas is not responsible for the privacy statements or other content on Web sites outside of The First National Bank and Trust Company of Weatherford, dba First Bank Texas and The First National Bank and Trust Company of Weatherford, dba First Bank Texas family of Web sites.

Use of your Personal Information

The First National Bank and Trust Company of Weatherford, dba First Bank Texas collects and uses your personal information to operate The First National Bank and Trust Company of Weatherford, dba First Bank Texas Web site and deliver the services you have requested. The First National Bank and Trust Company of Weatherford, dba First Bank Texas also uses your personally identifiable information to inform you of other products or services available from The First National Bank and Trust Company of Weatherford, dba First Bank Texas and its affiliates. The First National Bank and Trust Company of Weatherford, dba First Bank Texas may also contact you via surveys to conduct research about your opinion of current services or of potential new services that may be offered.

The First National Bank and Trust Company of Weatherford, dba First Bank Texas does not sell, rent, or lease its customer lists to third parties. The First National Bank and Trust Company of Weatherford, dba First Bank Texas may, from time to time, contact you on behalf of external business partners about a particular offering that may be of interest to you. In those cases, your unique personally identifiable information (e-mail, name, address, telephone number) is not transferred to the third party. In addition, The First National Bank and Trust Company of Weatherford, dba First Bank Texas may share data with trusted partners to help us perform statistical analysis, send you email or postal mail, provide customer support, or arrange for deliveries. All such third parties are prohibited from using your personal information except to provide these services to The First National Bank and Trust Company of Weatherford, dba First Bank Texas, and they are required to maintain the confidentiality of your information.

The First National Bank and Trust Company of Weatherford, dba First Bank Texas does not use or disclose sensitive personal information, such as race, religion, or political affiliations, without your explicit consent.

The First National Bank and Trust Company of Weatherford, dba First Bank Texas keeps track of the Web sites and pages our customers visit within The First National Bank and Trust Company of Weatherford, dba First Bank Texas, in order to determine what The First National Bank and Trust Company of Weatherford, dba First Bank Texas services are the most popular. This data is used to deliver customized content and advertising within The First National Bank and Trust Company of Weatherford, dba First Bank Texas to customers whose behavior indicates that they are interested in a particular subject area.

The First National Bank and Trust Company of Weatherford, dba First Bank Texas web sites will disclose your personal information, without notice, only if required to do so by law or in the good faith belief that such action is necessary to: (a) conform to the edicts of the law or comply with legal process served on The First National Bank and Trust Company of Weatherford, dba First Bank Texas or the site; (b) protect and defend the rights or property of The First National Bank and Trust Company of Weatherford, dba First Bank Texas; and, (c) act under exigent circumstances to protect the personal safety of users of The First National Bank and Trust Company of Weatherford, dba First Bank Texas, or the public.

Use of Cookies

The First National Bank and Trust Company of Weatherford, dba First Bank Texas web site use “cookies” to help you personalize your online experience. A cookie is a text file that is placed on your hard disk by a web page server. Cookies cannot be used to run programs or deliver viruses to your computer. Cookies are uniquely assigned to you and can only be read by a web server in the domain that issued the cookie to you.

One of the primary purposes of cookies is to provide a convenience feature to save you time. The purpose of a cookie is to tell the Web server that you have returned to a specific page. For example, if you personalize The First National Bank and Trust Company of Weatherford, dba First Bank Texas pages, or register with The First National Bank and Trust Company of Weatherford, dba First Bank Texas site or services, a cookie helps The First National Bank and Trust Company of Weatherford, dba First Bank Texas to recall your specific information on subsequent visits. This simplifies the process of recording your personal information, such as billing addresses, shipping addresses, and so on. When you return to the same The First National Bank and Trust Company of Weatherford, dba First Bank Texas web site, the information you previously provided can be retrieved, so you can easily use the First National Bank and Trust Company of Weatherford, dba First Bank Texas features that you customized.

You have the ability to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. If you choose to decline cookies, you may not be able to fully experience the interactive features of The First National Bank and Trust Company of Weatherford, dba First Bank Texas services or web sites you visit.

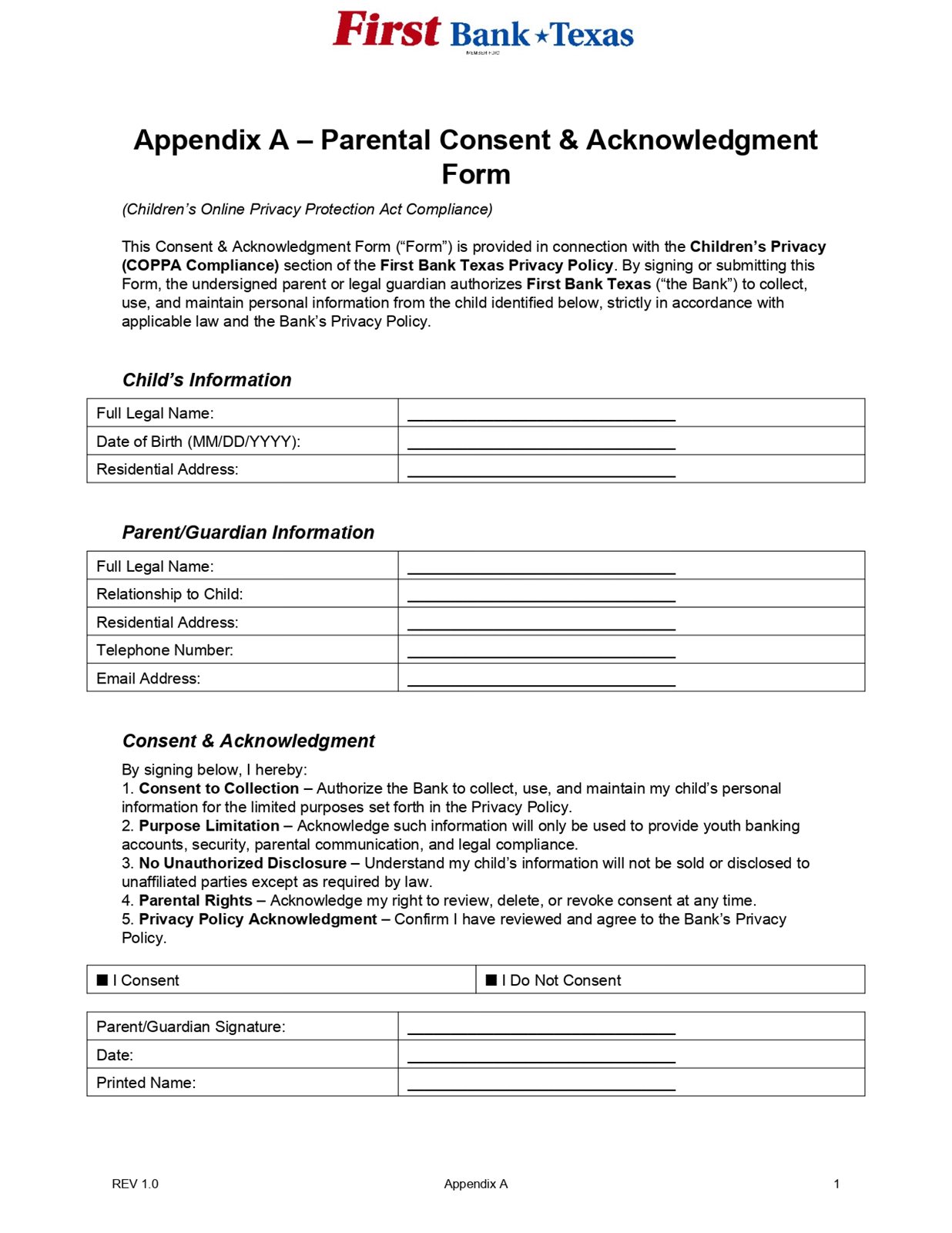

Children’s Privacy (COPPA Compliance)

1. Applicability

This section is adopted in accordance with the Children’s Online Privacy Protection Act of 1998 (COPPA), 15 U.S.C. §§ 6501–6506, and implementing regulations, 16 C.F.R. Part 312. It applies to the collection, use, and disclosure of personal information obtained by First Bank Texas from individuals under the age of thirteen (13).

2. Collection of Information from Children

The Bank does not knowingly collect personal information from children under thirteen (13) years of age without first obtaining verifiable parental or legal guardian consent. Where such consent is obtained, the Bank may collect the following categories of information (“Children’s Information”):

- Identifying details (e.g., name, date of birth, mailing address, contact information);

- Account identifiers, login credentials, and financial data necessary to establish and maintain youth accounts;

- Parent or guardian contact details to facilitate consent, communication, and oversight.

3. Use of Children’s Information

Children’s Information may be used solely for the following authorized purposes:

- Establishing, servicing, and administering youth deposit or related banking products;

- Protecting account security and verifying identity;

- Complying with the Bank’s legal, regulatory, and supervisory obligations;

- Communicating with parents or guardians regarding account status, activity, and security.

The Bank does not sell, license, or otherwise disclose Children’s Information to unaffiliated third parties except:

- As required by law, regulation, subpoena, or other legal process;

- To vendors, service providers, and agents engaged by the Bank who are bound by confidentiality and security obligations; or

- With the express authorization of a parent or guardian.

4. Parental Rights and Controls

In accordance with COPPA, parents and legal guardians retain the right to:

- Review the Children’s Information collected by the Bank;

- Request correction or deletion of such information;

- Revoke previously granted consent, in which case the Bank will cease further collection and use of Children’s Information.

5. Exercising Rights

Requests relating to Children’s Information, including revocation of consent, must be submitted in writing to:

First Bank Texas

108 Vine St.

Abilene, TX 79602

compliance@go2fbt.com

(325) 795-6301

Upon receipt of a verifiable request, the Bank will respond within a commercially reasonable period consistent with applicable law. Parent/Guardian authorization can be completed by attesting to the COPPA Parental Consent & Acknowledgement Form (Appendix A).

Security of Your Personal Information

The First National Bank and Trust Company of Weatherford, dba First Bank Texas, secures your personal information from unauthorized access, use, or disclosure. Personally identifiable information you provide is stored on computer servers in a controlled, secure environment. When personal information (such as a credit card number) is transmitted to other websites, it is protected through encryption technologies such as Secure Socket Layer (SSL).

Changes to this Statement

The First National Bank and Trust Company of Weatherford, dba First Bank Texas, may occasionally update this Statement of Privacy to reflect company and customer feedback. We encourage you to review this Statement periodically to remain informed about how the Bank is protecting your information.

Contact Information

The First National Bank and Trust Company of Weatherford, dba First Bank Texas, welcomes your comments regarding this Statement of Privacy. If you believe that the Bank has not adhered to this Statement, please contact us at customerservice@go2fbt.com. We will use commercially reasonable efforts to promptly investigate and resolve the issue.

Exceptions to Policy

Requests for exceptions to this policy must be specific and may only apply to individual items, not entire sections. Bank personnel requesting exceptions must submit their request via internal email to the FBT Compliance group for consideration by the Compliance Officer. All exceptions will be tracked and reported to the Board.